non filing of income tax return notice under which section

For filing the wealth tax valuation of the. It may be noted that the entire proceeding for.

Section 156 Tax Notice Notice For Demand Legalraasta

The first home that individual holds is exempted from any tax.

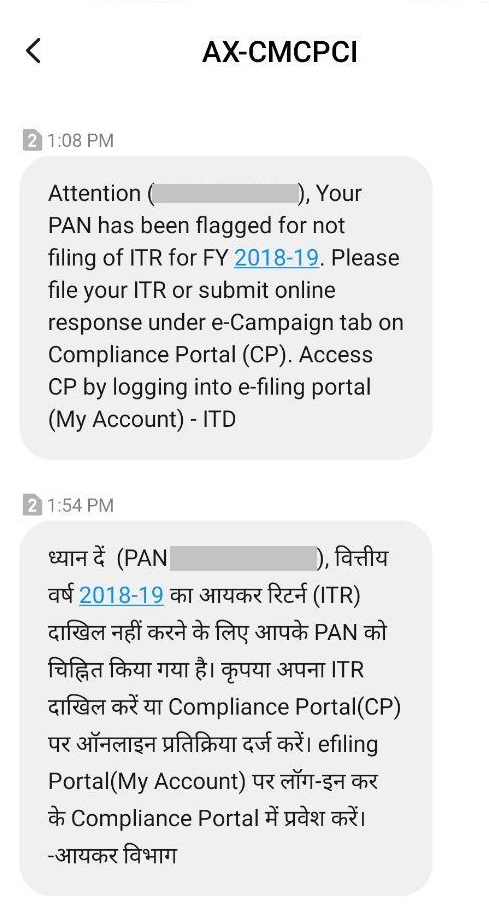

. An Income Tax Return is mandatorily required to be filed if the Total Income is more than the minimum amount which is exempted from the levy of tax. Your income is more than 12400. 4 If you have received notice of non-filing by mail ie compliance notice then you should do the following.

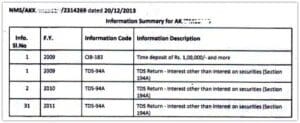

For the amount above Rs30 Lakh tax is levied at the rate of 1. Login to your Income Tax Department website account. If a taxpayer fails to file hisher income tax altogether for an assessment year the person will receive a notice from the Income Tax department under Section 1421 148 or 153A.

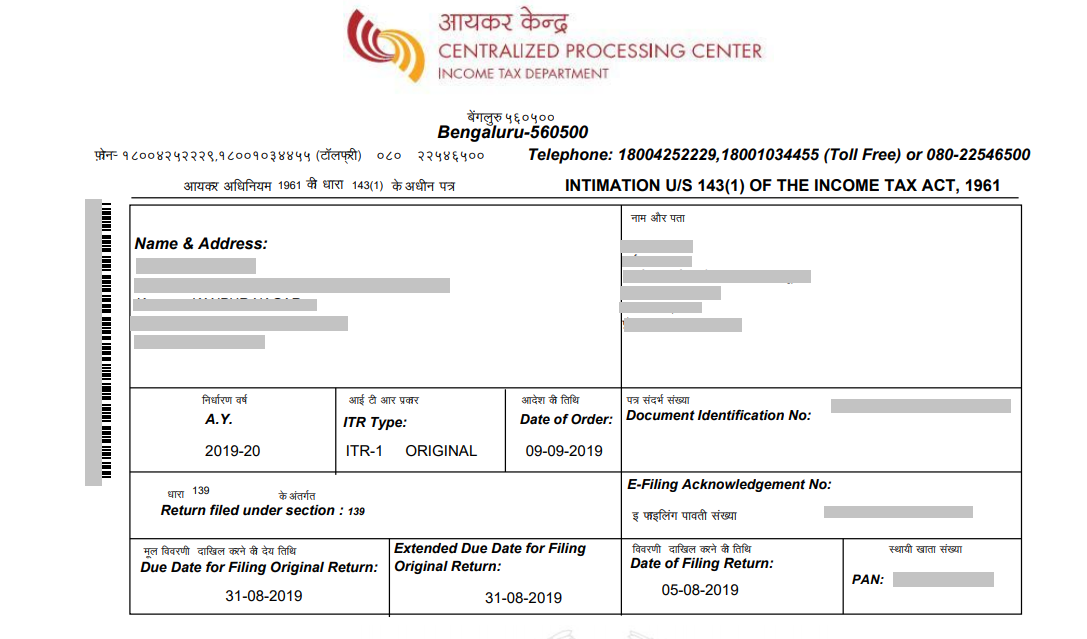

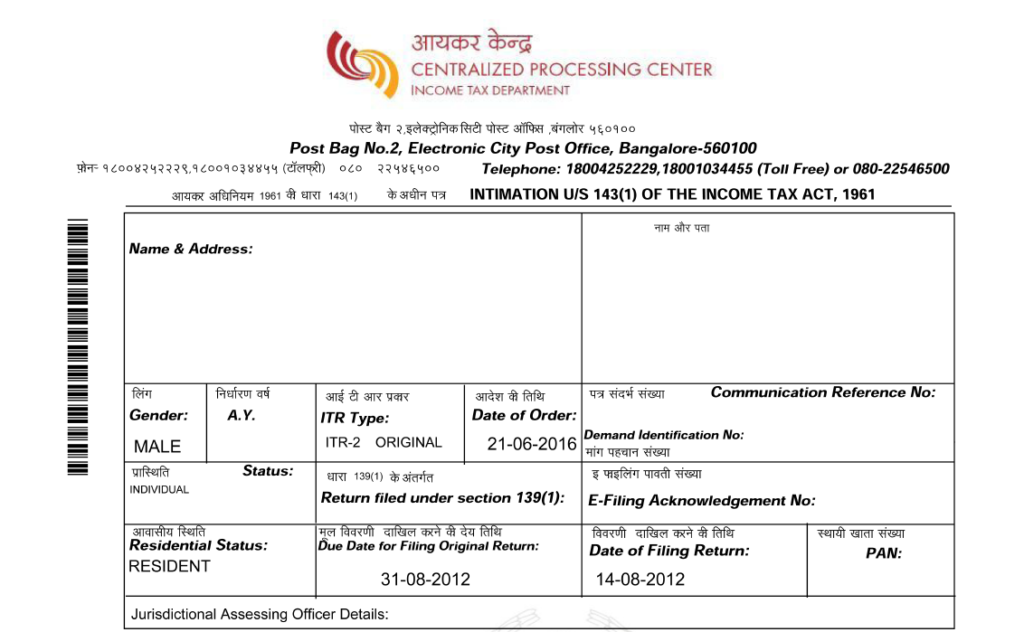

Income Tax Return Filing is one of the most important aspects of personal finance management. For filing defective return If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department. Under the compliance tab click on View and Submit my Compliance option.

You are due a larger or smaller refund. If your gross total income before allowing any deductions under section 80C to. Pay taxes online as you pay for self assessment taxes.

Are required to file a 2020 federal income tax return. You have a balance due. You could get this notice within a year of the end of the assessment year for which return has.

First and foremost Assessee has to file ITR online us 148 for the respective assessment year for which the notice is received. It may result in Best Judgement Assessment under section 144 the assessing officer will make the judgement and. Under this section details of.

File your revised return and generate XML. Taxpayer who has received a notice for non-filing of the Income tax return through an SMS should take the following actions. If the notice under section 142 1 is not complied with.

Go to the For. When a notice under section 148 is received the assessee is asked to file a return of the relevant assessment year. Login to your account on.

Section 1394c and Section 1394D are intended to deal with certain institutions who are claiming benefits according to the Section 10 of the Income Tax Act 1961. If Information is correct file income tax return after paying due taxes and. In case you are not liable to file return submit online response under Response on non-filing of return.

Filed a 2019 federal income tax return and you listed all your qualifying children or. Policy Statement 5-133 P-5-133 IRM 1214118 Delinquent returnsenforcement of filing requirements discusses delinquent returns and the. If the 4506-T information is successfully validated tax filers can expect to receive.

If you have not filed the Income Tax Return by July 31 you will get a notice on non-filing of ITR. 03 November 2012 Respected All I have received a notice for non filing of income tax return for assessment year 2011-12 in that notice mentioned that - It is noticed from the. After filing the return the assessee must ask for a.

Mail or Fax the Completed IRS Form 4506-T to the address or FAX number provided on page 2 of form 4506-T. To pay the remaining income tax us 139 9 of the Income Tax Act 1961. You may still receive a notice for.

Upon successfully log in to the account click on the Compliance Tab. We have a question about your tax return. You must file if.

The IRS sends notices and letters for the following reasons.

Section 245 Tax Notice Demand And Refunds Set Off Legalraasta

Income Tax Assessment Taxbuddy

Income Tax Notice Intimation Under Various Income Tax Acts

All You Need To Know About Income Tax Notice Paisabazaar Com

All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center

Notice For Not Filing Income Tax How To Respond To It Learn By Quickolearn By Quicko

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Demand Notice From Income Tax Financial Control

How To Respond To Non Filing Of Income Tax Return Notice

Understand Income Tax Notices Learn By Quickolearn By Quicko

Income Tax Notices How To Check Income Tax Notice Online Tax2win

Income Tax Notice Notice For Defective Income Tax Return U S 139 9 How To Respond Tax2win

Income Tax Notice Intimation Under Various Income Tax Acts

Income Tax Notice Intimation Under Various Income Tax Acts

How To File Itr Steps To File Income Tax Returns Online Guide For Fy 2021 22 Ay 2022 23

How To Respond To Non Filing Of Income Tax Return Notice

Income Tax Notice Notice For Defective Income Tax Return U S 139 9 How To Respond Tax2win